On August 16, 2022, we passed the midway point of the hottest month in North American history; Putin’s forces marched on the Donbas; spot prices on natural gas hit the highest level in 14 years; and the US Congress passed the most consequential climate bill in history.

It's a new era for clean energy and decarbonization.

Over the next decade, experts have estimated total investments in clean energy & decarbonization projects will be as much as $3 trillion. To catalyze that investment, the new Inflation Reduction Act (IRA) will make hundreds of billions of dollars of tax credits available to companies building facilities or producing clean power and materials. And, for the first time, these credits are transferable – creating a new and powerful market mechanism to fund energy transition projects. Transferable tax credits need standards, more buyers, expanded financial products, and purpose-built software.

The IRA is a critical downpayment on our energy transition, but we’re still at risk of moving too slowly. Successful deployment of the funds provided by the IRA will require the concerted effort of the government and businesses across the country. The private sector – in particular – has a generational opportunity to channel much-needed financial support to the energy transition.

We’re launching Crux to make sustainable finance more efficient and interconnected. Our network and tools will help developers, tax credit buyers, and financial institutions transact & manage transferable tax credits. Over time, we expect to expand to other financial products that help developers efficiently finance projects.

This is a multidisciplinary challenge that will require a multidisciplinary team. We have built an early team with decades of experience in the power industry, project finance, financial markets, and software engineering – particularly in regulated industries. Allen and I had the privilege of co-founding, building, and selling a marketplace software company. I then joined the Treasury Department as Deputy Chief of Staff. My work there built on my previous experience as Senior Advisor for Financial Markets at Treasury – and my experiences at BlackRock and in financial technology. Rob Parker joins us most recently from REV Renewables where he was CFO; prior to that, he was at AES, Google, and LS Power. Our rapidly growing product and engineering team have scaled products to millions, and to large enterprises in regulated industries.

Today, we’re proud to officially announce Crux and the closing of our first $4.6 million of funding, led by Lowercarbon Capital. Chris Sacca and his team were early investors in our last company and we’re excited to work together again.

Additional investors include New System Ventures, Overture, Ardent Venture Partners, the Three Cairns Group, and Bolt, a QED seed program. Individual investors include the founders of multi-billion dollar finance and clean energy companies, top energy finance lawyers, the partners of leading venture capital firms, Lee Sachs of Gallatin Point, and Henry Kravis of KKR. Investors in the company collectively generate billions of dollars of tax credits annually. Ian Samuels of New System Ventures played an especially pivotal role incubating this company and being a visionary thought partner, and will continue to play an important role as a founding advisor.

We’re also excited to be featured in an article in CNBC.

We’re thrilled to kick-off our Crux journey. Read on for more details about the energy transition, our story, and how you can join the Crux ecosystem.

Clean energy prices have decreased dramatically in the last decade: the cost of electricity from solar power decreased 85% between 2010 and 2020 and the cost of wind energy fell by roughly 50%, according to a United Nations report. And 2022 was a record year for clean energy growth. This growth was especially stark in light of severe energy disruptions impacting much of the world.

With costs falling rapidly, investments in clean energy and decarbonization are surging. Developers, manufacturers, and other parties invested a record-breaking $495 billion worldwide into clean energy in 2022. And analysts project the growth of clean energy to continue in the years ahead: one estimate says clean energy will account for 95% of the increase in global power capacity through 2026.

All of this to say: the market for clean energy and decarbonization was already growing rapidly – even before Congress stepped in to accelerate the energy transition with the Inflation Reduction Act.

As Dan Lashof of the World Resources Institute said:

“This legislation truly is transformative. It gives long-term investment certainty, which will really mobilize capital and transform our energy system.”

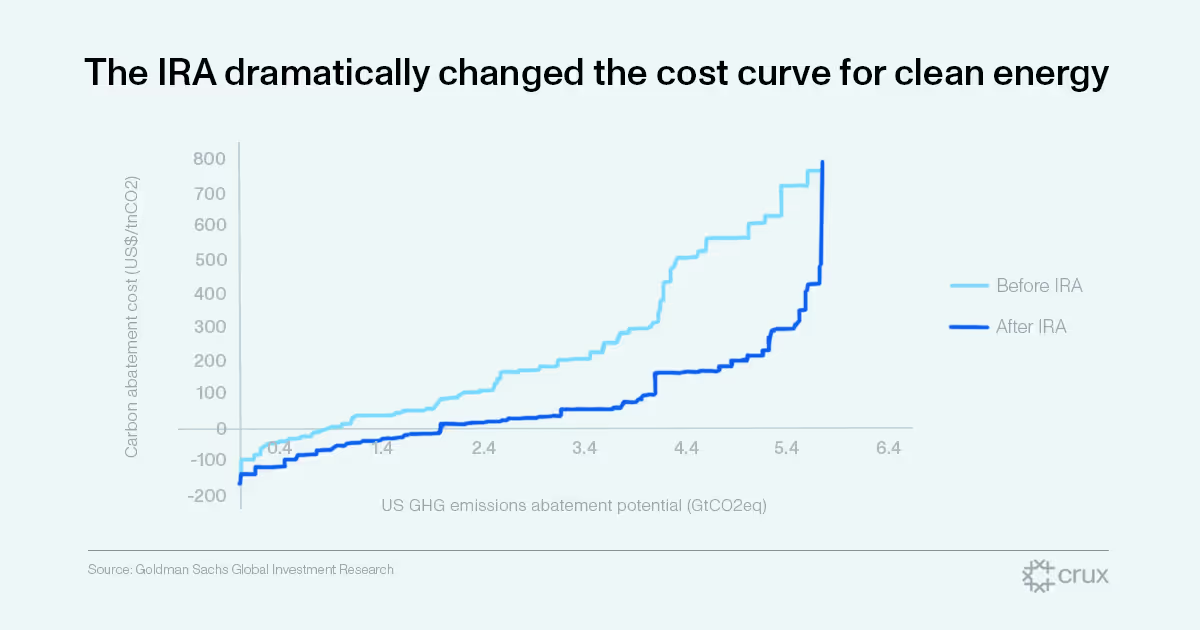

After years of uncertain climate policy, the IRA provided long-term incentives and expansive subsidies for clean energy and decarbonization – principally in the form of an estimated $271B-$800B in tax credits over the next 10 years.

Estimates project $11 trillion invested in clean energy by 2050. But, while the IRA puts a downpayment on our energy transition, there’s more work to do to ensure clean energy projects get off (and into) the ground as fast as possible.

While more projects will be financially viable thanks to the tax credits offered by the IRA, we need to turn the hundreds of billions in tax credits into shovels in the ground as quickly as possible.

The speed of the energy transition will depend on available capital for developers. The tax credits are a core component of how clean energy is financed – often representing a third or more of the capital invested. However, most developers cannot use these tax credits directly. To take advantage of them, they need to partner with others who have sufficient tax liability to consume them. Before the IRA, the primary structure for clean energy developers to monetize tax credits was a particular form of financing known as tax equity. In these transactions, a partnership structure is created, allowing others with sufficient tax liability to become part owners of the project and benefit directly from the tax attributes.

Tax equity is a valuable tool for monetizing depreciation and stepping up the eligible basis, but it involves complicated and expensive legal structures. Over the next ten years, the annual volume of tax credits and attributes to be monetized is expected to reach $80-100 billion. This supply will quickly surpass the capacity of the tax equity market. Developers are already experiencing this constraint today. We need new and more efficient financial tools. And the IRA offered one critical new mechanism: transferable tax credits.

The IRA made clean energy tax credits transferable for the first time. Now, developers can sell their tax credits to unrelated third parties for cash. And companies of all sizes can buy tax credits to offset a portion of their tax liability and invest in clean energy. Individuals may also be able to buy credits to offset taxes related to passive income.

Many developers will continue to use tax equity to monetize depreciation and optimize the eligible project value, but transferability will become a key alternative and complementary tool. In many cases, tax equity and credit transfers will be used in concert.

Transferable credits have some key attributes that make them attractive to developers:

Read more about how we see the market for transferable credits forming.

As Lily Batchelder, Assistant Secretary of the Treasury for Tax Policy, said recently:

Transferability will “act as a force multiplier for companies and enable communities, startups, and nonprofits to access the credits. Projects will get built more quickly and affordably to reduce costs for families and businesses, and more communities will benefit.”

Banks, advisors, and syndicators will play a critical role in this new market, as they have in the tax equity market, educating the market and navigating complex transactions. Intermediaries in this market also require modern solutions to transact these tax credits efficiently, all to supercharge the energy transition.

So we started Crux: an ecosystem to make sustainable finance more efficient and interconnected – starting with transferable tax credits.

Transferability will likely create a new, multi-hundred billion dollar market in the months and years ahead. This is an enormous, multidisciplinary problem. At Crux, we're laser-focused on opportunity for the many different people and organizations around the table to take advantage of this new market:

Our network and tools will help all parties streamline the transaction process, access a large & liquid market, and reduce risk through our tools and advisory partners – facilitating more and cheaper transactions that achieve internal goals and accelerate the energy transition.

This complex, new market is still taking form. Guidance from the Department of Treasury is being released regularly. Our collective experience at Treasury, in the power sector, and building technology in highly regulated industries prepares us to navigate this evolving landscape and support our clients. We’re also working with experts & partners including global tax law firm Allen & Overy and leading bipartisan climate government affairs firm Boundary Stone Partners to advise our clients and build the right tools.

We’ve been hard at work building the Crux ecosystem: hundreds of conversations with developers, buyers, advisors, financial institutions; working on some of the earliest transactions; building a team that reflects the complexity of the problem; and building the right early software product to accelerate these transactions.

We are a team of engineers, energy project finance veterans, builders of marketplace software platforms, financial markets experts, and former policymakers working to tackle one of the defining problems of our generation.

And we’re continuing to grow our team in the weeks and months ahead – click here to see our job openings, share them with your network, and help us find the best talent to tackle this complex and critical problem.

Are you ready to join the Crux ecosystem? Take less than a minute to get in touch, and we’ll share more with you and get you started as soon as possible.