The passage of the Inflation Reduction Act (IRA) in 2022 marked the most significant public investment in clean and renewable energy in US history. As we’ve written, the scale of the investment opportunity is vast. The IRA also allows many clean energy tax credits to be transferred from the project developer to virtually any corporate taxpayer. These transferable tax credits (TTCs) have the potential to drive as much as $83 billion in annual clean energy investment, accounting for roughly 1/6th of all corporate tax liabilities, by 2031 according to an estimate from Credit Suisse.

We recently discussed the way that CFOs across industries are sizing up the market for TTCs and preparing for their first transaction. For many, the opportunity to save on tax costs while supporting clean energy deployment is an irresistible combination — investing in profitability and sustainability goals at the same time.

Fundamentally, the IRA seeks to facilitate the large-scale deployment of clean and renewable energy across the power, industrial, and transport sectors in the pursuit of transforming the US economy to a low-carbon economy. This monumental transition has complex dependencies on regulatory and financial processes, which CFOs outside the energy industry may find themselves laboring to appreciate. Corporate tax buyers don’t need to be energy experts to take advantage of TTCs, yet we know that many have questions about energy market dynamics when evaluating TTC investment opportunities.

Today, we offer our take on three key market themes that have grabbed headlines in recent months:

News coverage this year highlighted the importance of reforms to the project interconnection process in order for wind, solar, and energy storage capacity to enter service. Interconnection – the process by which individual energy projects can tie into the US bulk power system – is governed by large, established players like power utilities and independent system operators. Recently, there has been an important market update as a key federal regulator took action to begin to clear that project backlog.

The chief federal power market regulator, the Federal Energy Regulatory Commission (FERC), voted unanimously in July to reform the interconnection process for new wind, solar, and energy storage projects. Historically, projects lined up in interconnection queues on a “first come, first served” basis, essentially acting like a printer queue in a busy office. In recent years, a crush of projects from new developers created congestion in these queues, while some well-capitalized projects waited for their turn — sometimes meaning a years-long delay. In the printer metaphor, it's as if someone is printing dozens of test pages ahead of a pack of meeting materials for a Board meeting that’s starting in five minutes. With the new FERC rules, project developers will be served on a “first ready, first served” basis, and projects with all of their ducks in a row get to jump the queue.

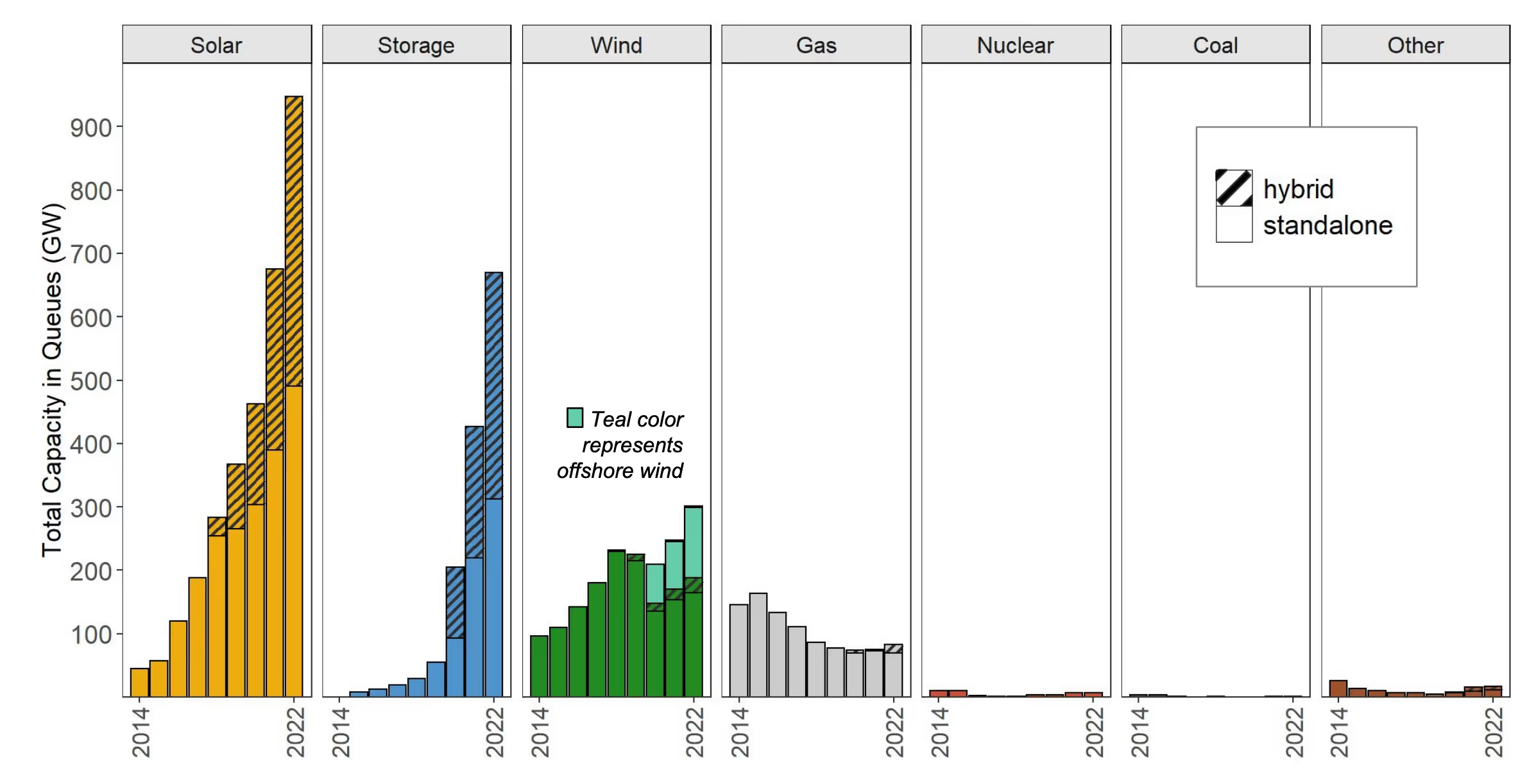

And this is no minor issue: as of writing, over 2,000 gigawatts of new projects sit in interconnection queues waiting for permission to plug into the grid — 1.6 times the total installed power generating capacity in the US. Overwhelmingly, these are renewable energy projects, as a 2022 study by the Lawrence Berkeley National Lab found (figure 1). To put that capacity figure into perspective, 2,000 GW of renewable capacity could represent ~$3.2 trillion in capex, or ~$960 billion in tax credits (assuming $1,600/kw project cost and a 30% ITC). A recent study by Bloomberg New Energy Finance estimated that the cumulative cost to achieve net zero by 2050 in the power sector is $5.6 trillion — projects sitting in interconnection queues today could bridge more than half the distance to net zero.

The supply of new projects and their streamlined interconnection are critical to supporting the next decade of the energy transition. Previously, renewable energy development consisted of hundreds of projects financed by fewer than 100 major tax equity players. We expect that this decade will see a step change — to thousands of projects and tens of thousands of TTC partners supporting the financing of new energy projects. At Crux, we know that TTCs can and will improve market liquidity and accelerate the pace of transactions and ultimately project development.

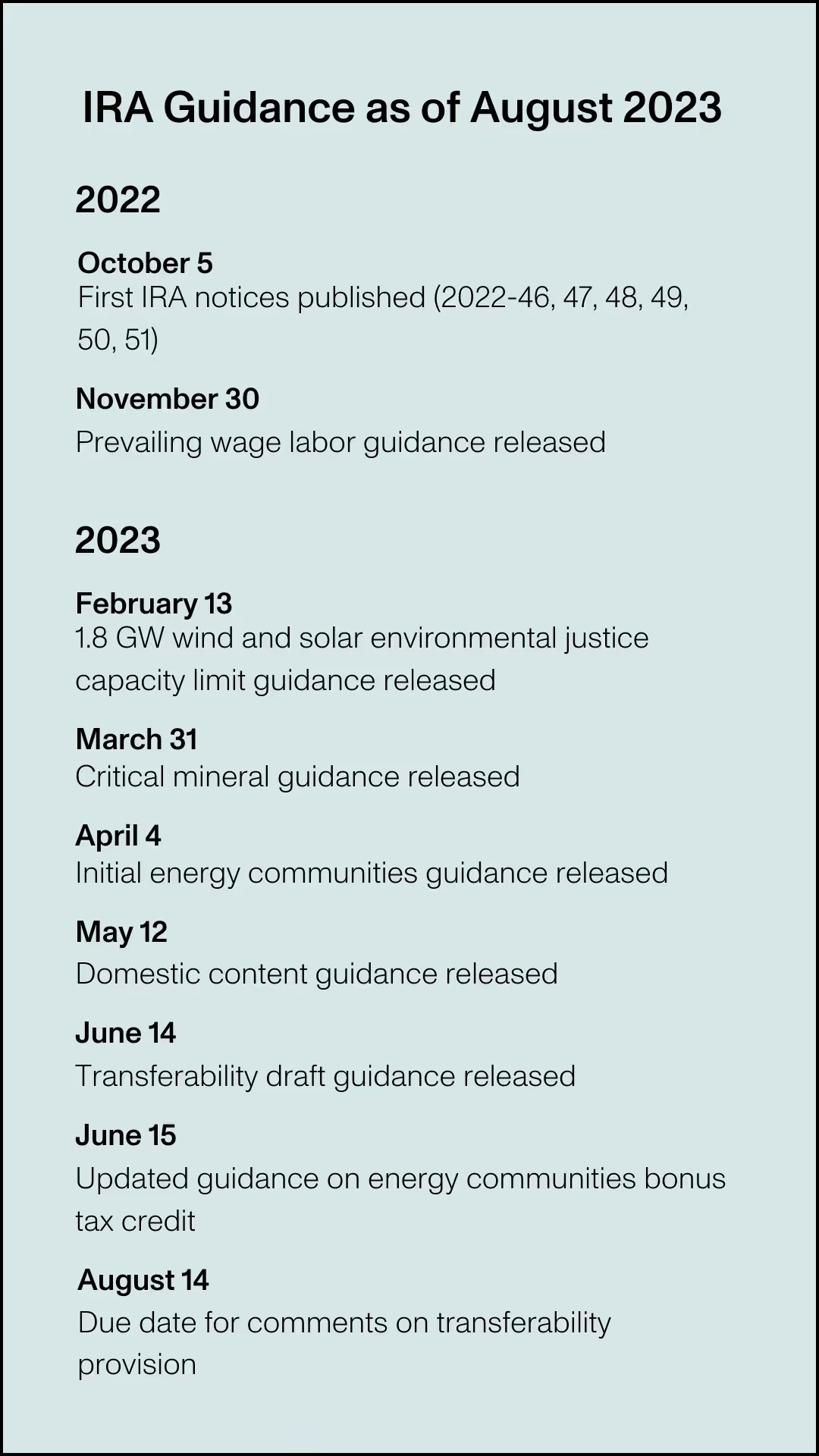

The IRA is an expansive law — and implementing it is no trivial amount of work for the US government, particularly the Treasury Department and IRS. Treasury has already issued important draft guidance on the transferability provision in the IRA, as well as on many other important provisions of the IRA (see table). Comments were due for the transferability provision on August 14, after which point we expect the agency to finalize the core components of transferability through the end of this year.

Implementation is ongoing and the Treasury and IRS are giving the market more clarity through the rulemaking process.

Guidance on these incentives will continue to issue forth throughout the rest of the year, and with it, the market will gain additional clarity on the value of the IRA credits and on the functioning of the TTC marketplace.

Rising interest rates have made capital more expensive for project developers — a fact which hasn’t escaped the notice of the media. Since most renewable energy projects have low-to-no marginal operating costs (the wind and sun are free), the bulk of the projects’ cost is up-front capital. Thermal energy projects like gas and coal plants, by contrast, have significant ongoing operating costs like fuel purchases and running pollution control equipment.

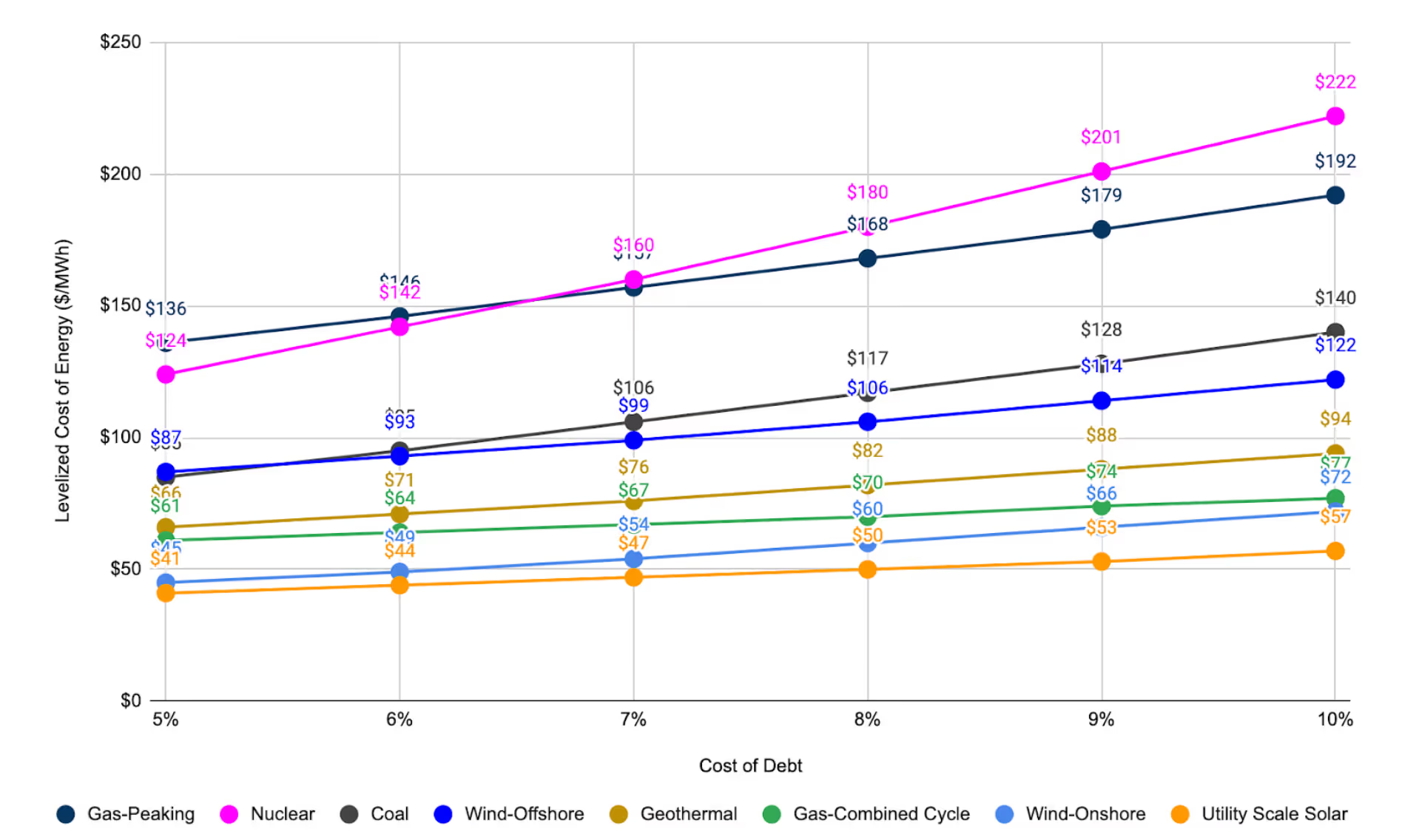

Energy economists normalize these two different operating cost profiles by calculating something called a levelized cost of energy (LCOE), which estimates the per-unit cost of generating each megawatt of electricity over the project’s useful life. As the argument goes, higher interest rates increase the LCOE for wind and solar more than for conventional thermal plants due to the higher proportion of capex associated with renewable LCOEs.

Except this line of thinking misses the most important point: the cost of developing wind and solar projects has declined so significantly in the last decade that, even with recent increases in capital costs, renewable projects remain competitive on an LCOE basis. In a recent white paper, Lazard, a financial advisory firm, modeled the impact of higher costs of capital on power projects and found that even at a 10% cost of debt (and 16% cost of equity) onshore wind and solar projects remain cheaper on an LCOE basis compared to the next-cheapest technology, the natural gas combined cycle plant, even before IRA credits.

Passage of the IRA can significantly defray the cost of new wind and solar construction. Lazard’s study concludes that the subsidized cost of wind and solar under the IRA drives LCOE down even further – as low as $0/MWh. TTCs introduce another unique cost saving measure as well. Higher interest rates will lead to higher yield requirements for tax equity partnership flips – raising the “cost” of tax equity to the developer. TTCs, by contrast, are not beholden to the tax equity partnership model and avoid that complexity.

Certainly, individual projects can face financial hurdles driven by rising interest rates, costs, and availability of equipment and labor. However, renewable energy projects remain highly competitive despite higher costs of capital.

For individual TTC transactions (and in most of our conversations), this macro picture is not the focus. Projects that are preparing to transact in TTCs have typically cleared the interconnection and financing hurdles discussed above. Crux has built a multidisciplinary team of energy and power experts with decades of industry experience in order to assist our clients in cutting through the noise and clearing up uncertainties regarding the reality of the fast-moving transition to clean energy.